Jan

16

Thermal Energy Storage Could Make Money

January 16, 2013 | 4 Comments

The U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) has released a study that suggests Thermal Energy Storage (TES) can make money for utilities. The study relies on Concentrated Solar Power (CSP) for the energy source. Keep in mind the study is coming from a government entity. The report, “Simulating the Value of Concentrating Solar Power with Thermal Energy Storage in a Production Cost Model” is available for download as a pdf file.

Working with a six-hour storage capacity the authors NREL’s Paul Denholm and Marissa Hummon, propose to put the solar energy back on line at times of lower peak net loads when the sun isn’t shining, enough to add $35.80 per megawatt hour to the capacity and operational value of the utility. The reported gain is compared to photovoltaic (PV) solar power alone, and would be an even higher extra value when compared to CSP without storage.

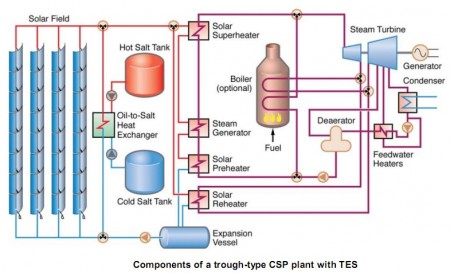

Concentrated Solar Plant with Thermal Energy Storage Block Diagram. Click image for the largest view.

The study does have a basis in realism. The authors point out that renewable sources like solar are variable and not entirely predictable. They are limited as compared to fossil fuels or nuclear that for a practical point can run at 100% on demand, 24/7/365. That requires the limited energy available to be optimally dispatched to provide maximum value to the grid. To do that there must be storage.

The values are possible because thermal stored energy allows CSP to displace more expensive gas-fired generation during peak loads, rather than displacing baseload lower-priced coal; and because it can continue to flatten the peak load in the evenings when PV isn’t contributing to the mix because the sun has set.

The authors simulated grid operations in two balancing areas primarily in Colorado where real data can be acquired to base the study. The bureaucrats at the NREL are impressed enough that they’re using the same methodology developed for the Colorado scenario for the more complex California system controlled by the California Independent System Operator. A report on the value that CSP with thermal storage adds to the California system is expected early next year.

What makes the study useful is capacity value in a production cost model, a measure that a traditional utility would use as for evaluation and as a planning tool.

Denholm and Hummon used the Energy Exemplar PLEXOS simulation model, a proven power market simulation software that uses cutting-edge mathematical programming and stochastic optimization techniques in use worldwide, that allowed them to isolate the relative value of thermal energy storage with and without storage.

CSP with TES, with an ability to store thermal energy in, say, molten salt, can use its heat-energy to drive turbines at power plants over a much longer portion of the day. Mark Mehos, manager of NREL’s Concentrating Solar Power program said, “We’ve known for a long time that CSP with storage adds significant value, however, we are now able to quantify this value in the language utilities understand.”

Denholm explains the driving point of the study, “With Concentrated Solar Power with thermal storage, you aren’t diving as deep into the generation stack (of possible generation sources), (competing with) displacing cheaper and cheaper fuel,” Denholm said. “You’re always displacing the highest-cost fuel.”

This sets up CSP with TES to operate the generation in the evening to lower the peak loads when electricity use can still be high, but PV isn’t available. So, it helps utilities offset the need to build new gas-fired generators in order to meet the electricity demand when the sun goes down.

“CSP with thermal storage can continually reduce that peak demand as the peak moves into the evening,” Hummon said. “It continually maintains a high operational value and high capacity value.”

A deeper look past the press release reveals the study shows the operational value of each technology represents its ability to avoid the variable cost of operation. These costs were tracked in three cost categories – operating fuel, variable operation and maintenance, and start-up costs. Operating fuel includes all fuel used to operate the power plant fleet while generating and includes the impact of variable heat rates and operating plants at part load to provide ancillary services. Start-up costs include both the start fuel, as well as additional operation and maintenance required during the plant start process. In each case the operational value was calculated by dividing the total avoided generation cost in each cost category by the total potential solar generation.

In that the study is quite fair and useful. When running costs are considered CSP with TES can be quite competitive.

The variables the authors deal with are quite complex. To reduce it runs a risk of misinterpretation. The big variables the authors roll in are the mix of generation types, the proportion of renewable sources in the generation mix, and the demand parameters. The study looks good in that respect.

What are missing are the sunken capital costs. No clear picture is offered in the data pool to recover the amortized capital invested.

Noteworthy information did pop out. The simulation was run with 8 hours of storage and no changes to the solar multiple. The value of CSP only increased slightly. It looks more clear now that storage for longer than 6 or 7 hours is a very poor use of capital. The sooner a facility would switch from deposit into storage to drawing the energy back from storage is important and does wonders for the economics.

What has been learned is when the simulated CSP with TES plants were dispatched to avoid the highest-cost generation, generally shifting energy production to the morning and evening in non-summer months and shifting energy towards the end of the day in summer months, CSP/TES minimized the overall system production cost by reducing use of the least-efficient gas generators. Not buying so much peak load fuel can be very financially attractive.

The authors put some pretty good thought and numbers into proving what seems eminently to be common sense – cutting fuel costs at peak loads with renewable energy sources can be a lucrative use of capital.

Comments

4 Comments so far

what did they “study” ? they presented a theory not a study … and it won’t save any money … you can wave your hands and talk about peak load fuel costs all you want but guess what, its the same cost for fuel at any load …

also all of that equipment costs money and more importantly manpower to run … I’d bet it would take as many staff to run this solar field as it takes to run an entire gas fired power plant …

Nuclear power makes far more sense both from an electrical standpoint and from a thermal standpoint, for most applications.

Energy density of sunlight is far too low for most industrial and large scale commercial uses.

The people who originate these ideas are not practical people, but tend to be academics or people who think like academics. They would happily squander every bit of society’s resources chasing after a pet phantom idea of particular interest to them.

These particular researchers are struggling to justify the existence of their jobs, and even the existence of the publicly funded labs in which they work.

The 6 speed automatic transmission shifts smoothly and has a manual mode that makes it more fun.

4-liter 4-cylinder Family 0 engine assigned to the Chevy

Volt and the Chevy Cruze are slated for production in Flint, Michigan.

Furthermore the exterior is beautified with chrome coated door handles, twin-cockpit theme,

dynamic shaped headlamps, dual port front grille, concave shoulder line and more.

My Partner And I just have to tell you the fact that I’m just beginner to blog posting and thoroughly admired your website. Probably I am probably to save your article post . You absolutely have memorable article text. Get Pleasure From it for sharing with us your website write-up.