Aug

13

At ConocoPhillips’ Oil Sands Site

August 13, 2009 | 9 Comments

ConocoPhillips has big plans in the oil sands. They understand the length and breadth of the reserve and the attitude in Alberta is about as good, maybe the best of any province or state. While stringent regulations apply, they’re clearly set out, enforced with reason and the business ethic up there tends to support being clean and economical. Those points plus an expected 60% of reserve recovery in the first phase makes the oil business in the sands a great place to run a business.

But it’s very capital expensive. Its cold, qualified people are in short supply, and materials and supplies must come from a very long way off. Its not like these are gushers of money either, rather these kinds of wells are more like “cash cows” that regularly produce a steady income. The royalty terms are very smart too, nothing like the U.S. “stick it to the oil companies” practiced by the U.S. federal government or the states. The leases wait for payment so the companies can recover the invested capital and only peak at about 20% royalty. It’s sure way to build up an industry with loyalty and respect between the parties. It’s enough to make an American blanch; the Canadians are very smart people.

We visited the Surmont Project some 60 kilometers southeast of Fort McMurray. It’s a multiple phase, multiple decade steam assisted gravity drain method. ConocoPhillips thinks 60% primary recovery is possible. This looks like a conventional oil project. The mine able or quarry method will only work over about 18% of the oil sands as the current thinking is 75 meters of cover ends the mining and quarry methods economics. But time will tell on that estimates hard value.

ConocoPhillips is using an “in place” method that everyone is calling “in-situ” the Latin short form term. At depth much of the technology steps that Syncrude is using on the surface must be done deep underground. Once bubbled out of the ground the oil is upgraded like part of the Syncrude process or blended with light oils for shipping to “upgraders” who finish the product with cleaning and technologies that get the long carbon chains into workable sizes for the refineries.

ConocoPhillips has been at this a while now, well before the great price peak of 2008. Surmont phase 1 completed construction back in October 2007, and is now producing 18,000 barrels per day. They are still ramping up as time is used to warm the oil and sand deep below ground. Regulatory approval is complete for a larger phase 2 that will grow the facility to 83,000 barrels per day. Construction was due to start this year, but little sign of the heavy equipment was to be seen, and they are running out of nice weather. But the oil business has a knack for going ahead; perhaps a delay is in order for reasons other than the general economy. One can fairly expect that sometime in the mid 20 teens that the facility we saw will near its combined phase output of 110,000 barrels a day. That would be bigger than most any offshore rig in deep water with a much longer lifespan.

The Surmont lease is much larger than the little area we saw. ConocoPhillips expects that getting to full development for extracting the whole 60% portion 25 billion barrels below the land is 30 years.

The downhole work is quite interesting with some 18 wells on the pad with each having 2 bores, one for production and another (exactly as possible) 15 feet above to inject the steam. The wells are all directionally drilled down and curving to be horizontal at the bottom of the oil bearing sand below 300 meters continuing out another 2000 to 3000 feet. The current wells aren’t all the way out to 3000 feet and practice and experience is building. There is a great deal of money on the end of the boring machinery so very small steps to extend the lengths are taken.

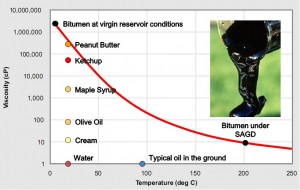

When the boreholes are filled with the necessary equipment steam is forced down the upper bore. As it warms the sand the oil, which is about the consistency of gum arabic and more solid, will flow as a liquid. Natural gas in injected at the end of the string and as it moves back up, now heated as well adding to the pressure it pulls along the liquified oil.

At the production facility the first thing the oil meets is a heat exchanger to salvage the heat. Then it moves on to treatment where oil and solvents are added to keep it a liquid state. The natural gas is then skimmed off the top and either recycled or used in the steam boilers.

ConocoPhillips doesn’t go as far as Syncrude to upgrade the oil. It ships to an upgrader that one assumes services several incoming streams. Somewhere along the way the sulfur and other impurities are getting removed.

In-situ or in place production isn’t using water for transport so its charge volume is much lower than the quarry method. It also disturbs less land at the cost of perhaps leaving 40% of the oil behind and taking much longer. But at that depth working open pit techniques such as mining or quarrying would be incredibly expensive and require huge amounts of cover removed to get to a small area.

Water is also on everyone’s mind at in-situ facilities. They too use lots of heat sourced from natural gas. Design has allowed the gas to do two jobs, lifting the oil out of the well and fueling the heat energy for making steam. ConocoPhillips isn’t using any surface water for the production at all. They pull deep brackish water from the Grand Rapids sands below 217 meters deep. The steam works uses 2.5 barrel of water to yield a barrel of oil. 90% is recycled leaving a quarter barrel to dispose of. That is injected deep, beyond the oil sands more than 400 meters deep.

How this differs is the bitumen oil is recovered using the latest downhole technologies, without fracturing efforts but with a constant supply of heat needed. The result is bitumen oil diluted with lighter oil to make it less viscous. What is needed is a much less expensive source of heat and much more hydrogen instead of lighter oil to liquefy the bitumen and increase the products and add some refinery gain.

For now Canadian bitumen oil is answering about 20% of the U.S. demand and the local people are looking to get past 40%. I wouldn’t be surprised as economic confidence increases, their goals will go up. I for one am glad for it.

Comments

9 Comments so far

Unsure what you mean by your comments on US taxes. 20 % seems consistant with what is here.

http://www.sourcewatch.org/index.php?title=U.S._federal_oil_and_gas_royalties

I don’t think this is extremely burdensome. of course no one like to pay taxes even oil companies. Whereas in many countries there is a chance that the government may seize your assets .

[…] ConocoPhilips’ oil sands site (New Energy & […]

Jim,

It’s the inconsistency of the Fed in it’s leasing and exploration policies that is the real problem. An exhorbitant down payment may be necessary before exploration can begin. And, a short window may be granted win for production to begin. But, of course, OGA’s and environmental suits often get involved and make hitting those windows impossible.

Then, if things are renegotiated, the terms become much less favorable for the company that actually found the oil.

That’s really how it works – even if that’s not on Wikipedia.

Matt

Excellent post, bookmarked your site in hopes to see more!

Nice stuff – straight to my bookmarks. I will come back again soon to read some more.

My partner and I really enjoyed reading this blog post, I was just itching to know do you trade featured posts? I am always trying to find someone to make trades with and merely thought I would ask.

This post makes a lot of sense !

I’ve just started off a blog, the knowledge you give on this site has aided me extremely. Thank you for all your time & work.

Post writing is also a excitement, if you know after that you can

write otherwise it is complex to write.