Nov

19

More American Oil

November 19, 2010 | 2 Comments

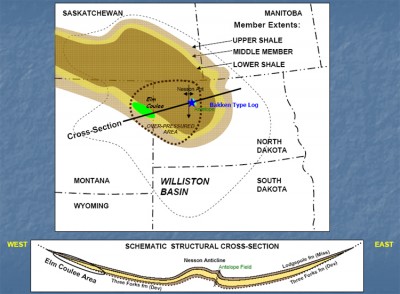

The rapidly getting famous Bakken Shale of the Williston Basin that stretches across a large portion of central North America is what most people consider as the latest great American oil field. But the Bakken is just one of the reservoir formations in the Williston.

There are more.

The Williston Basin is a vastly prolific area, one of the most prolific concentrations of onshore oil discoveries in all of North America. It covers an area of about 600,000 square miles. There are at least 11 different producing formations, including the Bakken, and others are now getting some scrutiny to see which ones are best and will get developed next.

For now the Bakken is the king of the Williston formations. Other formations are in the early stages of development that look like they could be the next big American oil resource play. One called the Viking Formation is certainly one of the big ones. The progress is so new there aren’t any formation area maps available for the Viking. What makes the Viking so special is that it is truly a blanket formation. When it’s drilled, there’s not really much concern among the producers about whether or not a well is going to hit the formation. It’s actually just a matter of what kind of production the well makes.

In other words the formation covers a broad area pretty much evenly such that most any well drilled will see some oil. This is very different from wildcatting, getting a seismic survey and perhaps do a test well before undertaking full development.

With much of the Bakken, and now most and perhaps even more of the Viking, you don’t actually need seismic. You can just drill the wells and be comfortable that the oil is going to be there.

The peak oil types and the doomers all think those days are long gone. Well, these wells don’t seem to ‘gush’ oil out of the ground – what casual observers think a well does when first drilled. But its been a long time since “punch a hole and get oil’ was part of oil patch.

The Viking is all light oil. It’s typically in the mid-30s for an API (American Petroleum Institute) range. It’s sweet, as it doesn’t have a lot of sulfur content. It doesn’t have a lot of associated water production as well. That usually translates to pretty good realized prices at and around West Texas Intermediate pricing. It also means that operating costs are usually lower, typically around $11 a barrel. What all that comes down to is high net income for payback. When a barrel of oil is sold for $80, essentially $40–$50 of that is translated to cash in the bank.

That’s the payoff from high oil prices. Much more oil.

It gets better. The Viking is a shallow formation. It’s about 700 meters or 2,100 feet deep. The producers are drilling shorter-length horizontals, usually about 800 meters in length or 2,400 feet. All in, that’s about 5,000 feet total well length, less than the water depth of the latest Gulf of Mexico offshore wells. That translates into cheap drilling costs. It’s about $1.2 million to drill and get a well ready for production. With sweet oil, a shallow formation and cheap drilling costs, the wells are paying out in slightly over a year. As a result, investment is recovered quite quickly. That means that after the first year, producers can just bank the cash or put it back into the ground for more wells and production growth.

Right now, the price difference between oil and gas forms a bias toward oil-producing companies. Natural gas in North America was expensive just a few years ago and the price drove exploration and development technology to flood the market so that the price fell dramatically.

The oil market is different, world wide and shipping liquids is much more practical than shipping natural gas. But the lesson remains – rising price drives more supply. Peak oil is a curious notion for those with little experience and a oil doom is nowhere in sight.

The noticeable thing is this time; at over $70 for a barrel alternatives can get a foothold. Now its up to consumers to stay conservative, absorb the oil price into expense planning and be ready for some price shocks.

Petroleum will be with us for a very long time and it’s a relief to see the price rise reinvested into more production. It’s not the world’s oil companies that are the problem.

Comments

2 Comments so far

The Bakken was a huge surprise to everyone and caught the anti-oil environmentalists by surprise. But, they will certainly attempt to halt exploration and production of these types of oil plays in the future.

And, of course, they are not limiting their anti-energy crusade to just oil. They are druming up lots of fake and annecdotal evidence against Fracking to stop shale gas recovery.

Keep posting stuff like this i really like it