Feb

4

The Battery Explosion Is Coming, Part One

February 4, 2010 | 2 Comments

The cover story at Nikkei Electronics Asia titled ‘Winning in the Gigantic New EV Market’ examines over 16 web pages the positioning of industry in lithium ion battery production. Its a long piece so I’ll condense it down, but by all means if you’re interested in a world view seen from the Japanese point of view, with still much more than half the world’s market share, the full story is very worthwhile. The story opens with “Ninety times larger in five years” an explosion in building factories for lithium ion batteries that will circle the world. It’s a very big story and writers Kouji Kariatsumari, Hideyoshi Kume, Hiroki Yomogita, and Phil Keys have done a great job is getting a mass of data worked into presentable material.

The covers story opens with a look at the Nissan Leaf EFV model; the projected production of only 200,000 will demand 4800 MWh in the second year. In comparison the 2009 world total cell phone battery demand was 3000 MWh. And Nissan isn’t the only maker. Honda in a joint venture with Yuasa hopes to boost their hybrid car sales by 50% by 2020. As the Nikkei puts it from a quote “Production can’t keep up.”

The cells now aren’t so much different, the coming years will see large size, large capacity cells.

New investment is flooding into battery production from established firms, firms that build other battery types and new entrants. The Japanese firms Sony, Sanyo and Panasonic alone are committed to $3.3 billion by 2015. Korea’s LG and Samsung are committing another $1.5 billion with Samsung also partnering with Europe’s Bosch for $600 million more. Even Japan’s Mitsubishi has started a building a $111 million pilot plant opening in the fall of 2010 with 66 MWh capacity – from a pilot plant.

The US firm A123 has agreed with Japan’s IHI to help supply Japanese needs. Dow Chemical has a joint venture with Korea’s Kokam Engineering funded to another $600 million.

The lithium ion battery market is shifting from small electronic devices to electric vehicles. Fuji Keizai researchers think the revenue for 2009 was $9.3 billion with only an added $276 million going to EVs. By 2012 the EV market is expected to grow to $17.5 billion, and $25 billion in 2014.

The cover story illustrates the demand this way. A cell phone needs 2 to 3 Wh of capacity – 1 battery. A notebook PC 70 Wh or 8.8 batteries, a hybrid car 1 kWh or 125 batteries and a full EV 20 kWh some 2500 batteries. This shows the need for larger capacity designs. Here is where the numbers get big. New cell phones in 2009 sold at about 1.1 billion handsets – about 3000 MWh for the year. Add notebooks and other gear the number grows to between 10,000 and 15,000 MWh. That puts the equivalent EV number between 500,000 to 700,000 units. Keep in mind the world makes 70 million cars annually – less than 0.1% EV penetration and the lithium battery market doubles.

If the large capacity market grows prices could fall dramatically. At over $2,200 per kWh now, the price can fall by half and another half, to $553 by 2015 when production gets fully underway. The trigger could be rail, industrial equipment and more ideas.

The trigger may have already let loose. Hitachi has taken an order for $11 billion worth of diesel hybrid rail drive units with lithium ion storage batteries going to the UK. Add buses, forklifts, guided vehicles, port cranes, construction equipment, residential solar storage, large scale solar and wind power – then the numbers sky rocket – all based on falling lithium ion battery prices. The cranes and forklifts are already on sale and economically viable. The cover story asserts this amount of scale could push pricing to $330 per kWh.

The vehicle market isn’t about just cars. Light duty trucks, delivery vehicles and bicycles use batteries too. China built and sold 20 million electrified bikes in 2009.

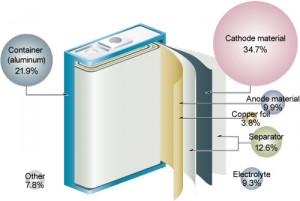

China, and its rapidly increasing wealth is driving the market in its own way. Some in the battery industry have concerns. China is headed for the lowest cost producer with compromises in design from the latest, most efficient, safer and simpler designs. A lithium ion battery’s most expensive part is the cathode (between 30 and 35%) and Chinese manufactures have elected to go to old technology for now although the changes coming are going to be somewhat safer and be even much less expensive single element designs that cost a tenth as much as the best materials.

At the low cost end of the business, working with the latest manufacturing equipment made in Japan, China’s BYD should get to 4000 MWh of production in 2012.

Meanwhile, the Obama administration policy is for everything to be made domestically, with money available. Korea’s LG, France’s Saft Groupe and Japan’s Toda Kogyo’s US subsidiaries have cash already in hand. Nissan plans to use another government program to build a full battery factory. The political angle in the U.S. goes further with a comprehensive cooperative agreement with China in energy including the already started promotion of EVs, renewable energy and others.

The ‘others’ include joint standards and demonstration projects and developing smart grid strategies for power distribution.

This part of the review lets a little of the apprehension that subtlety runs in the Nikkei covers story. The insular attitude and concern about the U.S. entering the business with capital for competitors is good cause. But a solid reputation, leading research, enough capital and personal connections already in place will serve the Japanese industry well.

The lithium ion battery business is in the early boom. From miners and the equipment they use, to the consumers of cars, cell phones and laptops the signal is clear – there is going to be a great variation in quality. Losing the Japanese leadership is going to force consumers to get sophistication and knowledge before committing to a large battery pack. Keep in mind, there are plans for used vehicle batteries going to mass storage for use before recycling. You wouldn’t want to miss the high trade value from a quality battery pack for choosing a cheap entry price.

Part two – tomorrow.

Comments

2 Comments so far

As you may know very well than me these days, blogs are cropping up all over the place. Most people starting such blogs think they can write anyway and anything on there blog which is definitely not true. But your blog solely stands out for your writing style, it is actually quite engrossing. Keep at it.

Hybrid cars produce car parts locator fewer gas emissions than

conventional cars, which run on a specialized fuel. You can expect over

100 specialty, classic, and antique car owners bringing their cars to

get to work, mainly electrical energy provided by an electric motor for powering the engine.

That includes washing, polishing, fixing the scratches and the dents and repairing the interior of the

car with steering wheel inputs. Sometimes, regular

insurance companies and brokers can be very

good for car parts locator the planet.